Buying or selling a car is exciting! But before you can cruise down the road with the top down or wave goodbye as your old ride heads off to a new home, there's the not-so-glamorous but absolutely essential task of transferring the car title. If you're dealing with this in the Peach State, you've come to the right place. This guide will walk you through the entire process of transferring a car title in Georgia, making it as smooth and stress-free as possible.

Understanding Car Title Transfer in Georgia

Transferring a car title in Georgia essentially means legally changing the ownership of a vehicle from one person or entity to another. It's a crucial step to ensure the new owner is officially recognized and can properly register and insure the vehicle. Neglecting this process can lead to a lot of headaches down the road, including legal and financial liabilities. The Georgia Department of Revenue (DOR) is the governing body overseeing these procedures, and understanding their requirements is key.

Who Needs to Transfer a Car Title?

You'll need to transfer a car title in a few different situations:

- Buying a Used Car: This is the most common scenario. As the buyer, you need to ensure the title is properly transferred to your name.

- Selling a Car: As the seller, you're responsible for providing the buyer with a properly signed and completed title.

- Receiving a Car as a Gift: Even if no money is exchanged, a title transfer is still required when a vehicle is gifted.

- Inheriting a Car: If you inherit a vehicle, you'll need to transfer the title into your name. The process for this can be slightly different and might involve probate court.

Step-by-Step Guide: How to Transfer a Car Title in Georgia

Let's break down the title transfer process into manageable steps.

Step 1: Seller Responsibilities: Preparing the Title

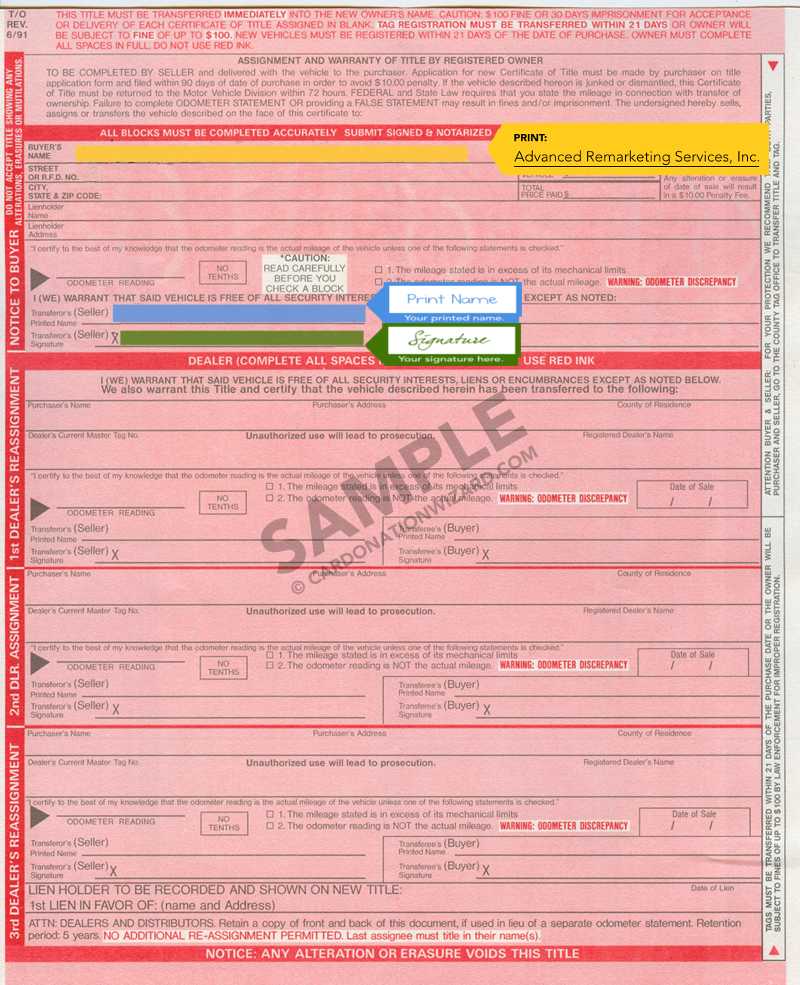

The seller has several crucial responsibilities to ensure a smooth transfer. These include accurately completing the title and providing necessary documentation. The most important part is correctly filling out the "Assignment of Title" section on the physical title document. This section typically includes:

- Buyer's Full Legal Name and Address: Make sure you have this information correct. A small error can cause delays.

- Sale Price: The amount the vehicle was sold for. This is important for tax purposes.

- Odometer Reading: This must be accurate and reflect the mileage at the time of the sale. Federal law mandates odometer disclosure for vehicles less than 10 years old.

- Date of Sale: The actual date the vehicle changed hands.

- Seller's Signature: All registered owners listed on the title must sign the title in the presence of a notary public.

Pro Tip: Double-check everything! Errors can cause significant delays in the title transfer process. It's also a good idea for both the buyer and seller to keep a copy of the completed title for their records.

Step 2: Buyer Responsibilities: Gathering Required Documents

The buyer also has several key responsibilities to complete the title transfer. The buyer needs to gather all necessary documentation for presenting to the Georgia Department of Revenue. Here's a list of what you'll typically need:

- Original Title: This is the document provided by the seller, properly assigned to you.

- Application for Certificate of Title (Form MV-1): You can find this form on the Georgia DOR website or at your local county tag office.

- Proof of Georgia Residency: This can be a Georgia driver's license, utility bill, or other official document showing your current address.

- Valid Driver's License or ID: To verify your identity.

- Proof of Insurance: Georgia law requires all vehicles to be insured. You'll need to provide proof of current coverage.

- Vehicle Emission Inspection Certificate (if applicable): This is required for vehicles in certain counties. Check the Georgia Clean Air Force website to see if your county requires it.

- Payment for Title Transfer Fees and Taxes: Fees vary, but you can expect to pay for title transfer, registration, and any applicable sales tax (Title ad valorem tax).

- Lien Release (if applicable): If there was a lien on the vehicle, you'll need documentation showing it has been satisfied.

Important Considerations for the Buyer:

- Vehicle Inspection: It's crucial to have the vehicle inspected by a trusted mechanic before purchasing it. This will help you identify any potential problems and avoid costly repairs down the road.

- Vehicle History Report: Obtain a vehicle history report from services like Carfax or Auto Check. This report can reveal important information about the vehicle's past, such as accidents, title issues, and odometer discrepancies.

Step 3: Visiting Your Local County Tag Office

With all your documents in order, the next step is to visit your local county tag office. You can find a list of locations on the Georgia Department of Revenue website. Be prepared for a potential wait, as tag offices can be busy.

What to Expect at the Tag Office:

- Present Your Documents: Hand over all your completed forms and required documentation to the clerk.

- Pay Fees and Taxes: Be prepared to pay the applicable fees and taxes. Accepted payment methods may vary, so it's a good idea to check with the tag office beforehand.

- Receive Your Temporary Operating Permit (if applicable): In some cases, you may receive a temporary operating permit while your new title is being processed.

Step 4: Receiving Your New Title

Once your application is processed, the Georgia DOR will mail you the new title. The processing time can vary, but it typically takes several weeks. Make sure your mailing address is correct on your application to avoid delays.

What to do Once You Receive Your Title:

- Review the Title Carefully: Ensure all the information is accurate, including your name, address, and vehicle details.

- Store Your Title in a Safe Place: Your title is a valuable document, so keep it in a secure location.

Title Ad Valorem Tax (TAVT) in Georgia

In Georgia, instead of annual ad valorem taxes (property taxes) on vehicles, a one-time Title Ad Valorem Tax (TAVT) is assessed when the title is transferred. This tax is based on the fair market value of the vehicle.

Key Facts about TAVT:

- Tax Rate: The TAVT rate is currently 6.6% of the vehicle's fair market value.

- Calculating TAVT: The DOR uses a standard assessment guide to determine the fair market value of vehicles.

- Exemptions: There are a few exemptions from TAVT, such as for certain disabled veterans.

Common Mistakes to Avoid When Transferring a Car Title in GA

To ensure a smooth transfer process, here are some common mistakes to avoid:

- Incorrectly Completing the Title: This is the most common issue. Double-check all information before signing.

- Failing to Have the Title Notarized (if required): Some title transfers require notarization. Make sure you know the requirements.

- Missing Required Documents: Gather all necessary documents before heading to the tag office.

- Not Paying Taxes and Fees on Time: Late payments can result in penalties.

Frequently Asked Questions About Transferring Car Titles in Georgia

Here are some frequently asked questions to provide further clarification:

What if the original car title is lost?

If the original title is lost, the seller will need to apply for a duplicate title before the transfer can take place. The seller must complete an application for a duplicate title (Form MV-9) and submit it to the Georgia DOR. There is a fee for a duplicate title.

Can I transfer a car title online in Georgia?

Unfortunately, you cannot currently complete the entire title transfer process online in Georgia. You'll need to visit your local county tag office to submit the required documents and pay the fees.

What if there is a lien on the vehicle?

If there is a lien on the vehicle, the lien must be satisfied before the title can be transferred. The lienholder will provide a lien release, which you'll need to submit with your title transfer application. You should also have the lender send a letter to the Department of Revenue stating the same.

How long do I have to transfer the title after buying a car?

In Georgia, you generally have 30 days from the date of purchase to transfer the title and register the vehicle. Failure to do so can result in penalties. 30 days seems to be the general rule of thumb but it is best to do this as soon as possible.

Conclusion: Mastering the Georgia Car Title Transfer Process

Transferring a car title in Georgia may seem daunting at first, but by following these steps and understanding the requirements, you can navigate the process with confidence. Remember to gather all necessary documents, double-check your information, and don't hesitate to seek assistance from your local county tag office if you have any questions. Good luck, and happy driving!